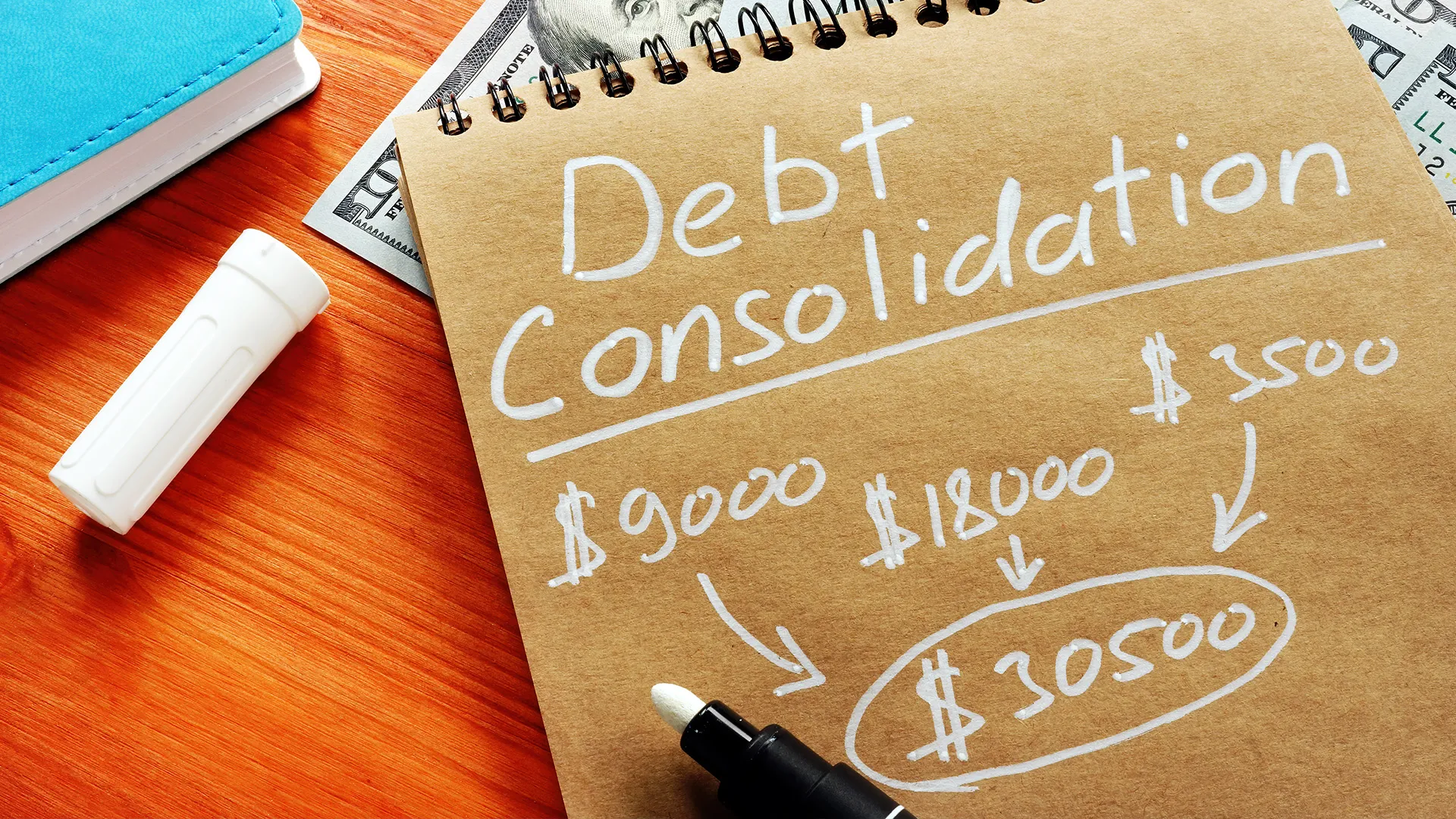

Debts can add up quickly and often lead to higher interest rates, making keeping up with monthly loan and credit card bills much more challenging. Properly handling debt is the key to keeping things manageable. One of the best ways to streamline payments and interest rates, is to consider debt consolidation, which rolls all your debts into a single fixed-interest monthly payment. Let’s take a look at how these loans from companies like Symple Lending can help you achieve financial goals.

Transfer Multiple Payments into One

A consolidated loan can occur by transferring several credit cards into a single one, personal loans, 401 K loans or a home equity loan. Debt consolidation simplifies your debt and can result in lower monthly repayments because they have a longer pay off period. However, being able to focus on onc debt makes it easier to track and pay off debts.

Reduced Interest Rates

Unsecured debts typically carry higher interest rates, which increases monthly payments. Giving priority to paying off high-interest loans and credit and consolidating the remaining ones can help secure lower interest rates and even boost your credit score.

Your credit score is a primary factor liners use when determining the interest rate of any loan, including debt consolidation loans. Paying off what debts you can before consolidating is likely to provide interest reductions compared to what you’re currently paying.

May Boost Your Credit Score

Should you choose to consolidate your debt, your FICO credit score can increase fairly quickly. Many who choose to take out a personal loan see a boost in their score in just a few months. When companies check out your application for a new loan or line of credit, they’ll ask for a copy of your credit report, which helps them evaluate the risks associated with funding your request. The better your credit is, the better your chances are of getting an approval.

Pay Off Debts Faster

Many debts can plague you for years before you can pay them off in full. This is why you should consider calling the skilled professionals from Symple Lending. They’ll explain the benefits of debt consolidation and discuss the process of obtaining one after multiple factors are considered.

This includes determining the length of the loan, your income, your credit score and the total amount you owe. This allows lenders to determine a repayment plan that you can realistically meet. For this reason, there is a shorter payback period for consolidated loans.

Ready To Get Out of Debt?

While loan consolidation can be a great solution for many, it may not be the best choice for others. A financial expert can assess your situation, determine your overall debt and make suggestions that best suit your financial situation. Should you choose to consolidate loans, an abundance of benefits can be enjoyed. Contact a financial advisor today to learn more.